Saving bank account open an online saving bank account with sbi.

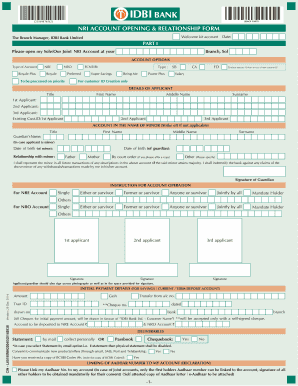

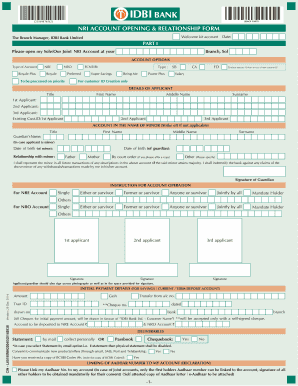

Idbi nro account opening online.

Note account can be opened by resident individual only.

Get mobile internet banking features with sms alerts.

Savings account application form.

Power plus average quarterly balance of rs 50 000.

However the procedure for opening the current account is a bit different compared to the savings one.

It is essential you need some documents to open a bank account with idbi bank.

Sign the requisite service charges depending on your preferred category of account and attach it along with the account opening form not applicable for nre nro fcnr term deposits.

All fields are compulsory.

Visit the website of any one of the popular banks prefer the bank you already have a relationship with and fill their nri account inquiry form.

Either you are opening a savings account or current account.

Account categories are divided into 4 types.

Super savings average quarterly balance of rs 5 000 b.

Nri account opening nri account opening.

The 1st option of account opening is easy convenient and completely online.

Now open an nri account online in 2 working days without the hassle of filling an application form.

Existing customer yes no account type service charge.

Title first name.

Are you a non resident indian nri.

Applicant mobile number.

Nris can now open a feature packed nro or nre account with sbi from any part of the world.

2 passport size photos.

Simple 3 step online process.

You should have a pan card.

Bank anywhere using the yono app.

Customers can now fill up the form online upload scanned copies of the documents and complete the application process.

Office phone number email id.

Permissible credits to nro account are transfers from rupee accounts of non resident banks remittances received in permitted currency from outside india through normal banking channels permitted currency tendered by account holder during his temporary visit to india legitimate dues in india of the account holder like current income like rent dividend pension interest etc sale proceeds.

Open bank account with a bank and trading demat accounts with a broker.

Nri account opening.